Automating Company Expenses with SaaS Solutions

Managing expenses can be tricky, especially as your SaaS company grows. In this post, we’ll dive into why tracking your spending is crucial, how SaaS can simplify the process, and even highlight some top tools to help you automate it.

Harun Basic

Co-founder

Reading time: 5 min

As your company grows, it becomes increasingly important to track expenses. This is key to the success of any company. It is not a novelty in the world of business, it is simply something that is necessary for every startup, small business or even large company. Here we are talking exclusively about SaaS. This includes various expenses such as software licenses, hosting, marketing, office supplies, payroll, subscriptions, etc.These are just some examples of expenses for SaaS companies. All these expenses should be managed carefully and constantly. A little carelessness can lead to the situation getting out of control.

What do we mean by that? We are talking about the leakage of expenses that can affect the bottom line of our business. As a solution to such problems, software will be used more and more often, through which we can monitor company expenses and create and use tactics that would reduce them. There are a good number of companies that are not aware of this problem and pay subscriptions for services that they don't really need, and they don't have a tool that automates expenses in the company. Why would they? "They can do it all by themselves on paper" - they are not even aware of how much time they waste in this way on such an important problem in the business world, and just how many mistakes they can make in this way.

What is SaaS? Why Does it Matter?

Before getting started with the role of SaaS in improving business expense tracking, it’s essential to understand what SaaS is.

SaaS, or Software as a Service, is a cloud-based solution that allows businesses to access and utilize software applications via the internet. The beauty of SaaS lies in its simplicity - no need for complicated installations. You pay for what you use, and the software takes care of the rest.

Benefits of Automating Expenses with SaaS:

Time is money, literally: Manually tracking expenses is a time-consuming process. SaaS solutions automate this, freeing up valuable time for your team to focus on more strategic tasks.

Precision in Every Penny: Manual expense tracking is a breeding ground for errors – from misplaced decimal points to miscalculated totals. SaaS solutions eradicate these risks by automating calculations and ensuring precision. Minimizing errors not only saves you from financial headaches but also builds a foundation of trust in your financial reporting.

Reducing Fraud Risks: Manual expense systems are susceptible to fraudulent activities, whether intentional or accidental. SaaS solutions incorporate robust security measures, including audit trails and user permissions, minimizing the risk of fraudulent expenses slipping through the cracks.

Real-Time Insights: Gain instant access to real-time expense data. No more waiting for month-end reports - with SaaS, you're always in the know.

Cost-Efficiency: Investing in SaaS solutions might seem like an additional expense, but the returns are substantial. The efficiency gained, reduced errors, and the strategic insights acquired far outweigh the initial investment. Consider it a smart move towards long-term cost-efficiency.

Choosing the Right SaaS Solution

Not all SaaS solutions are created equal. Here are some key considerations to guide your decision:

Scalability:

Consider the size of your company. Some SaaS solutions are tailored for small to medium enterprises (SMEs), while others offer robust features suitable for larger corporations.

Integration Capabilities:

Seamless integration is vital. Ensure the chosen SaaS solution can easily integrate with your existing software and systems, such as accounting software or ERP systems, to avoid disruptions in your workflow.

Mobile Accessibility:

Look for a SaaS solution that provides mobile accessibility, either through a dedicated mobile app or a mobile-responsive interface. This feature enables employees to submit expenses on-the-go, fostering efficiency.

Customization Options:

Every business has unique needs. Choose a SaaS solution that offers customization options to align with your specific expense policies, approval workflows, and reporting requirements.

Compliance and Security:

Given the sensitivity of financial data, prioritize security. Ensure the SaaS solution complies with industry regulations and implements robust security measures, such as encryption and secure access controls - trust me you don't want anyone but you to have access to such data!

Trial Period:

Take advantage of trial periods offered by many SaaS providers. This allows you to test the solution's functionality and compatibility with your business processes before making a commitment.

If you're ready to make the shift, here are our top three recommendations for SaaS expense automation:

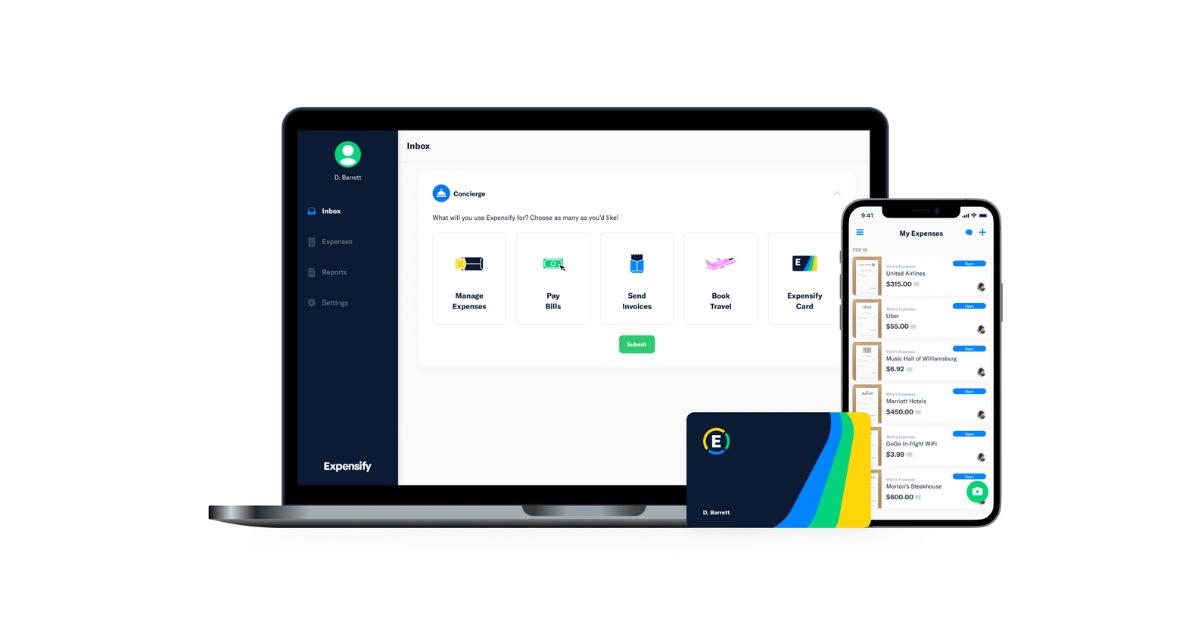

1. Expensify

Expensify is super easy to use, and it helps keep track of your expenses effortlessly. Just snap pictures of your receipts, and it takes care of the rest, making sure you get reimbursed on time. It's like having a personal assistant for your expenses, making it a great choice for any type of business.

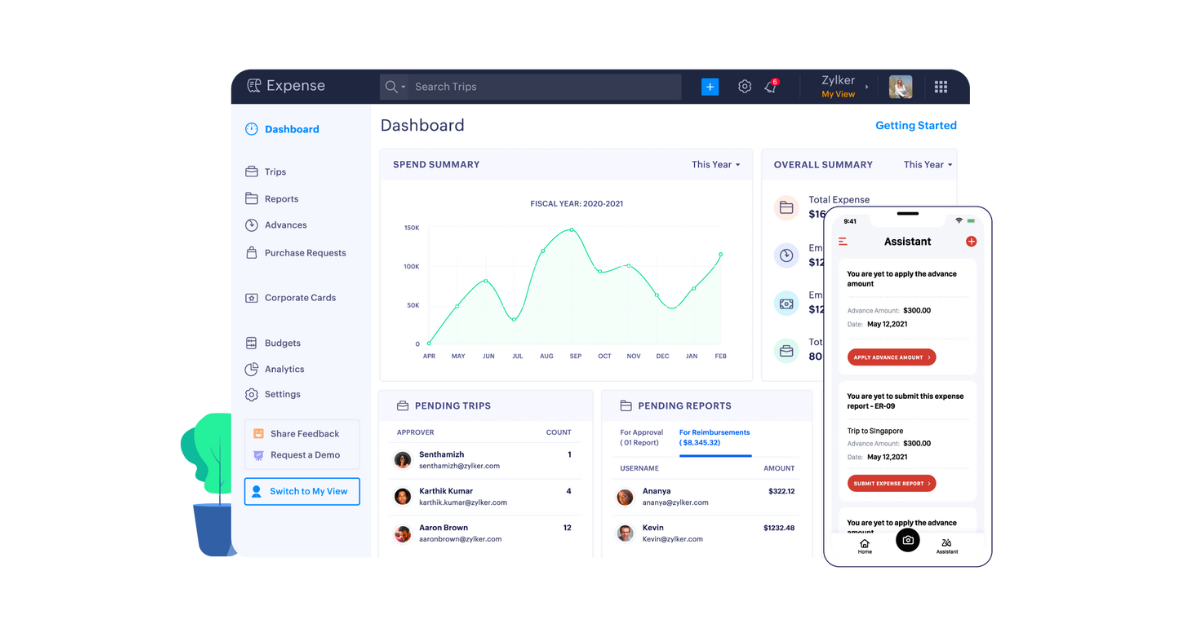

2. Zoho Expense

Zoho Expense is helpful for small and medium businesses. It lets you keep an eye on your spending and makes reporting super easy. You can customize it to fit your needs, making sure it works just the way you want it to without any fuss. With Zoho Expense, you can easily snap pictures of your receipts, organize your expenses, and generate reports effortlessly. What makes it even cooler is that you can tweak it to fit your own way of doing things.

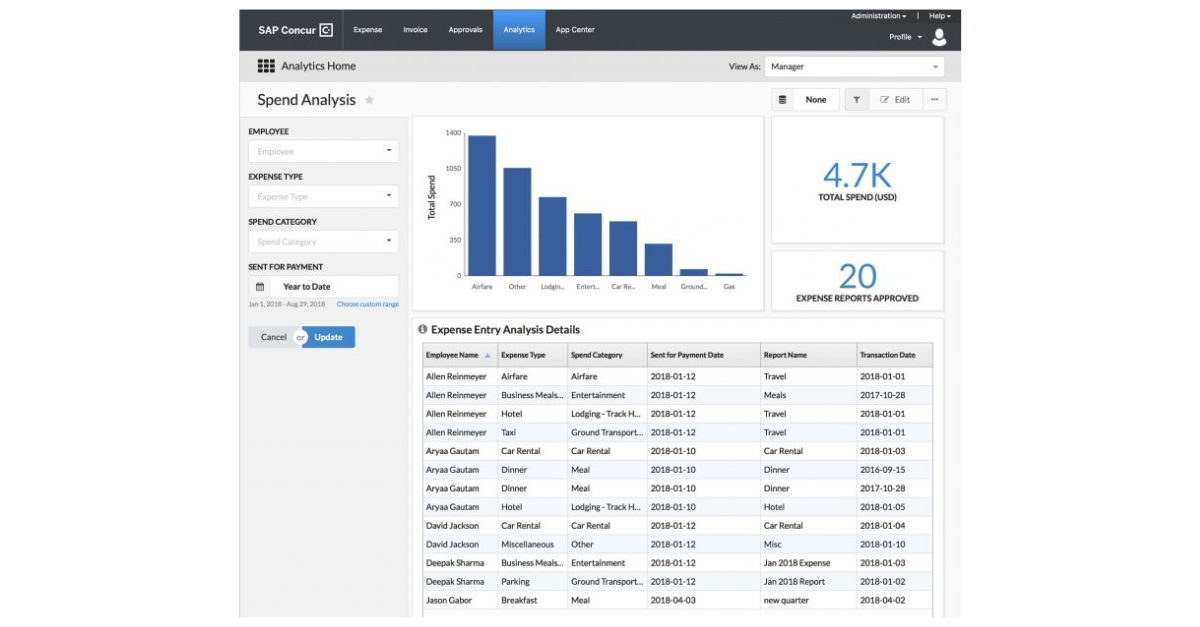

3. SAP Concur

SAP Concur is for larger enterprises seeking an all-encompassing solution. It does more than just track expenses – it helps manage travel plans and gives you smart insights. Cool, right?